Mega mergers and acquisitions in the global pharmaceutical industry: Implications for Africa’s health industry (Part 2)

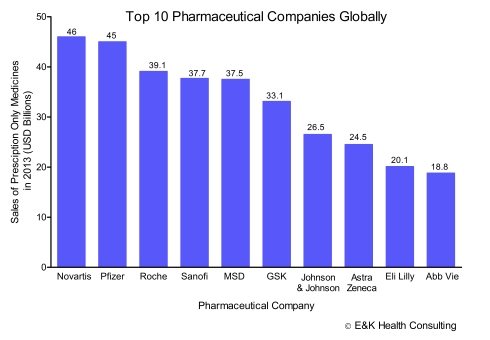

The past few months have witnessed a wave of mega mergers and acquisitions in the global pharmaceutical industry that herald new challenges for Africa’s health industry. A key concern is the risk that these mergers might abolish competition and generate monopolies in certain franchises thus driving up pharmaceutical product prices (and hence on cost of healthcare) in the continent.

It is imperative that Africa mitigates against these risks and we propose ideas on how best she can do this. Africa needs to front herself as a single market and thus afford herself bargaining power in terms of medical/pharmaceutical products procurement.

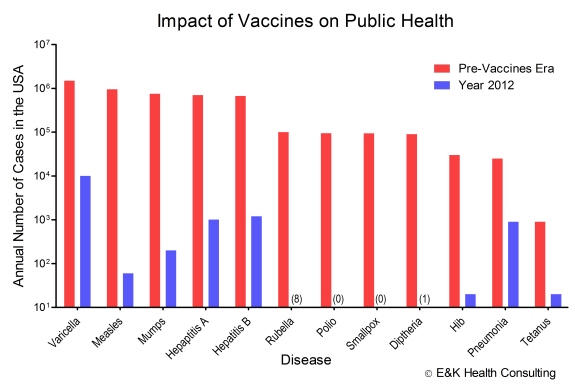

The potential of this approach is best exemplified by the vaccines procurement strategy championed by GAVI wherein Africa’s (and other countries beyond Africa) vaccine needs are consolidated into one bid on which basis price ceilings for several vaccines have been successfully negotiated (Read the Part 1 of the blog here:

Mega mergers and acquisitions in the global pharmaceutical industry: Implications for Africa’s health industry (pt.1)

).

Other compelling examples are the Affordable Medicines Facility-malaria (AMFm) programme (http://www.theglobalfund.org/en/amfm/) hosted by the Global Fund and the ‘Power of One’ campaign (https://secure.malarianomore.org/po1/#home) piloted in Zambia by Malaria No More with support from Novartis (in terms of provision of Coartem). The AMFm, a “factory-gate” financing mechanism for artemisinin-based combination therapies (ACTs) for malaria, is an initiative designed to increase access to the most effective treatment for malaria in the private, public and not-for-profit sectors. The Global Fund achieves this objective by negotiating with drug manufacturers to reduce the price of ACTs and match sales prices to first-line buyers in both public and private sectors.

This has seen first-line buyers pay up to 80% less than they would under free market conditions and has resulted in some success in increasing availability and affordability of ACTs in most participating countries, especially in the private sector (Arnold et al., Preliminary Report of the Independent Evaluation of AMFm Phase 1, ICF Macro and London School of Hygiene and Tropical Medicine, Calverton, MD, 2012). The ‘Power of One’ campaign initiative has seen Malaria No More and its partners negotiate the price of a dose of Coartem® (an ACT brand owned by Novartis) down to 1 US dollar, in part, by increasing the demand for the drug in Zambia.

The long-term success of these initiatives is largely hinged on the ability of African states to take up the financing obligations that have hitherto been largely met by international development organizations. Whereas securing commitment from African states has been challenging in the past, it is worth noting that there have been some promising cases. For instance, in the buy-in agreements between individual governments and GAVI, 64 out of 67 co-financing countries have fulfilled their buy-in commitments and GAVI has recently secured commitment to build on the vaccines buy-in strategy to 2020 (http://www.gavialliance.org/Funding/Resource-mobilisation/Process/GAVI-Replenishment-Launch-meeting-May-2014/). In light of this, the overall strategy of unifying Africa’s procurement bids is feasible and should be scaled up principally by increased ownership by African states.

Looking East

In related developments, there is an unprecedented ‘West-to-East’ shift in the global pharmaceutical industry with an increasing amount of global R&D, technical development and sales happening in the East, especially in China and India. This shift is in part driven by ongoing pricing and access pressure in Europe and the USA, a global wave of patent expirations and a rapid increase in smaller but faster growing pharmaceutical companies in the East. This shift is changing the global medical/pharmaceutical procurement dynamics and will continue to do so in the immediate future. For instance, while only 1 of the 5 key vaccine suppliers to GAVI was based in an emerging market in 2001, by 2013 more than half of the 12 key suppliers were based outside Europe and the USA. (http://www.gavialliance.org/advocacy-statistics/). On one hand, this shift is good for Africa in the short to medium term since it heralds the entry of new manufacturers and suppliers of pharmaceutical products and lessen the influence of the monopolies that arise out of the recent wave of mergers and acquisitions. On the other hand, in the long-term, it bears little impact for the continent.

This is because these new pharmaceutical companies, most of which are currently stand-alone enterprises, are bound to merge with each other (much for the same reasons that have driven the current wave of mergers and acquisitions) and thus create new monopolies which will pose similar risks to Africa in terms of increased costs of pharmaceutical products. Therefore, in the long term, Africa needs prudent leadership to build on the current successes (exemplified by GAVI, AMFm and Power of One) to further develop herself as a consolidated single market and thus afford herself bargaining power in terms of medical/pharmaceutical products procurement. This will allow her to tame her expenditure on health and channel more of her resources towards building capacity for science and research that will be a prerequisite if at all she is to ultimately manufacture and meet her own demand for medical and pharmaceutical products.

Disclaimer: This post represents the personal opinions of the writers and does not in any way represent the opinion of any pharmaceutical company, development agency or any other entity.